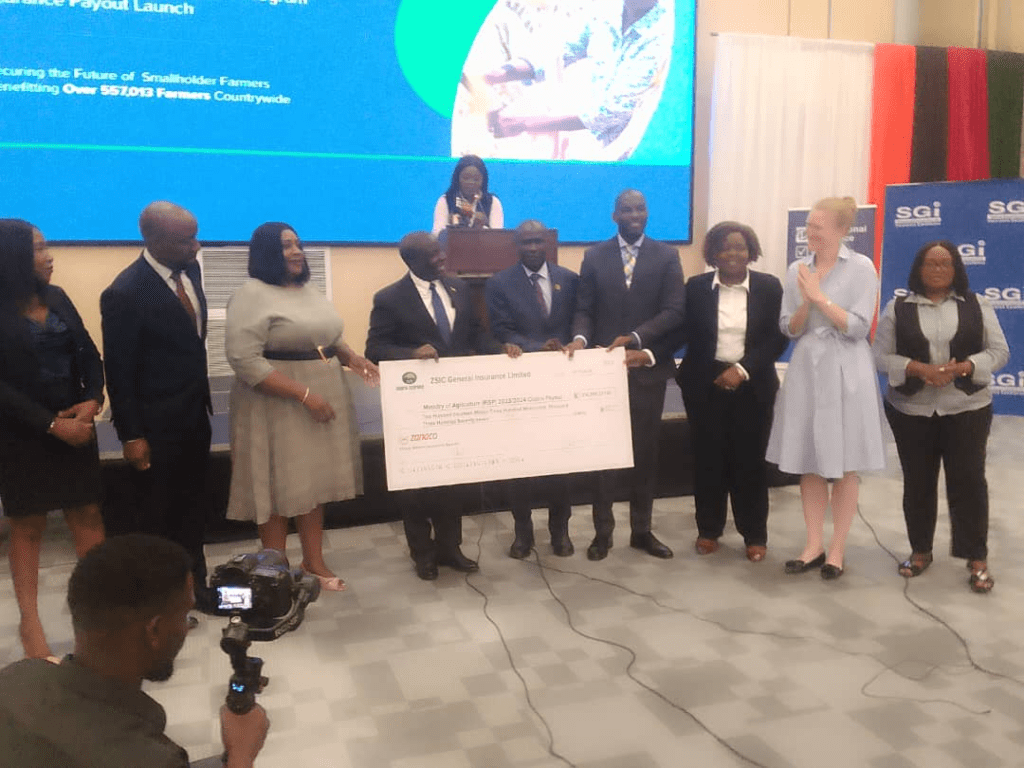

Over 500, 000 Farmers To Get K800 Million Under Crop Index Insurance Payout

A Consortium of four Insurance Companies, in partnership with Pula Advisors will pay out over K800 million to more than 500, 000 smallholder farmers under the Farmer Input Support Programme (FISP) during the 2023/2024 season, marking the largest crop index insurance payout in Zambia and Africa’s history.

The four Insurance firms include ZSIC General Insurance, Professional Insurance Corporation Zambia PLC (PICZ), Savenda General Insurance, and Madison General Insurance.

The payout marks a major milestone in building resilience and financial stability for Zambia’s farmers, providing them with crucial support to recover from climate-related losses and continue their important role in feeding our communities.

The crop insurance, underwritten by the Consortium of Insurance Companies in collaboration with PULA covered Maize, Soybeans, Sorghum, Rice and Millet across eight provinces of Zambia namely Copperbelt and North Western, Southern and Western, Eastern and Muchinga and Northern and Luapula provinces.

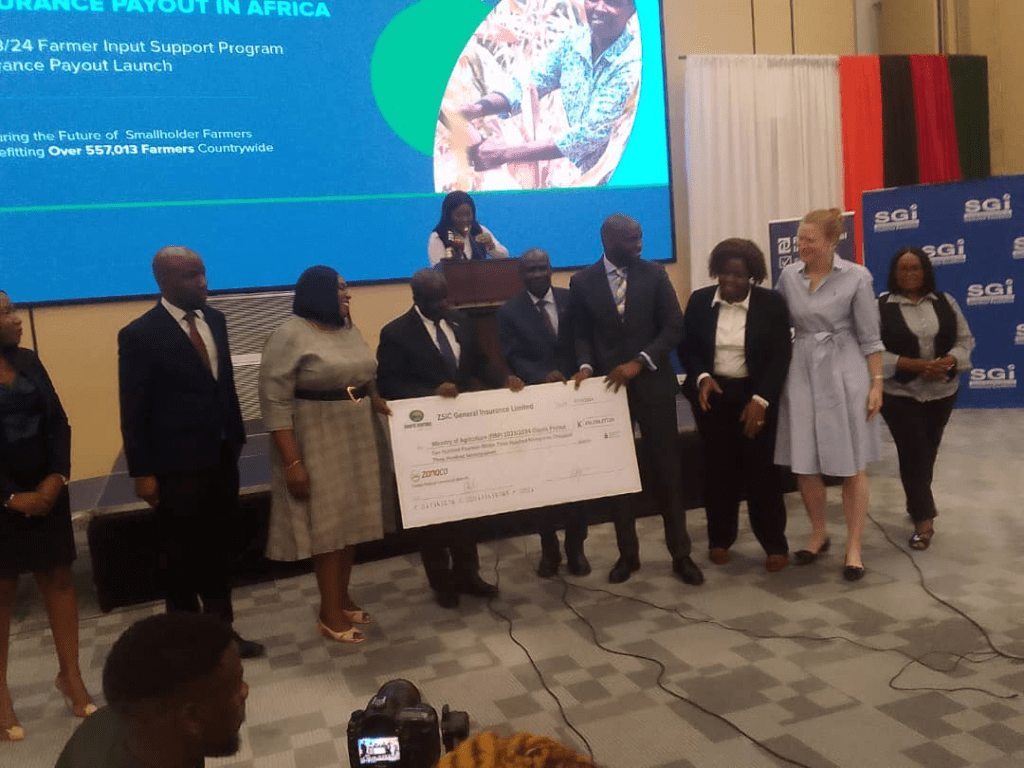

Officiating at the launch of the Crop Index Insurance Payout in Lusaka, Agriculture Minister, Reuben Mtolo said his Ministry took a strategic decision in 2015 to introduce crop insurance as a risk transfer tool on the FISP which is one of Government’s key pillars of its agricultural policy.

Mr. Mtolo revealed that the Hybrid Index Agricultural Insurance will see over 557,017 farmers out of the 802,488 farmers insured by the four Insurance companies get payouts to the tune of K809, 898,007.

“During the 2023/2024 farming season, 1,024,000 farmers were insured through this program supported by five local insurance companies.”

“As government it gives us great pleasure to know that our farmers will be cushioned from the devastating impacts of the drought giving them the opportunity to reinvest in their livelihoods. this is important for resilience and it is very important as we try to achieve a food resilient economy backed by a strong agriculture backbone,” Mr. Mtolo stated.

He revealed that approximately 3.5 million farmers still lack access to such services and stressed the need for the private sector to work collaboratively to bridge this gap so that they too are able to be in this position to recover from such climatic shocks.

Mr. Mtolo further implored farmers to ensure that they provide correct contact details, as it has been difficult to locate most of the farmers who have registered for various government programmes.

He also urged the Insurance companies to start looking at livestock and fisheries in their insurance products as agriculture is not just about crop production.

And speaking on behalf of the four insurance firms, Professional Insurance Corporation Zambia (PICZ) Managing Director, Moses Siame revealed that since inception in 2019, the consortium has insured over 2.5 million farmers under FISP between 2019 and 2023 farming seasons, making claim payouts in excess of K68 million.

“We are proud to fulfill our promise to indemnify the smallholder farmers insured under FISP and it is with great pleasure that we announce an insurance payout totaling to K788,044,208, under the Area Yield Index Insurance Component during the 2023/2024 farming.”

“This payout covers the losses suffered by the insured smallholder farmers following the devastating impact of the recent drought during the last farming season. Prior to this crop insurance launch, the Consortium paid of K21,853,800. This brings the total insurance payout to K809,898,007,” Mr. Siame disclosed.

He further said this brings the total insurance payouts to K950,283,867, since 2019/2020 farming season when the Consortium started the journey of providing risk management solutions to smallholder farmers under FISP.

“The insurance payout we are launching today is the result of a proactive decision by Government of through Ministry of Agriculture to secure crop insurance cover on behalf of the smallholder farmers on FISP with Professional Insurance Corporation Zambia PLC, Madison General Insurance, Savenda General Insurance and ZSIC General Insurance.”

“This proactive step ensured that in the face of adversity, such as the recent drought during the 2023/24 season, our farmers are not left without support,” he added.